Setting Up for the New Week

Last week was certainly one for the ages. It had everything a bull and bear would love and hate. March 23rd will go down as the internal or momentum low for this bear market, if that’s even the right term anymore. By internal low, I am referring to the bottom where the biggest swath of damage was done, where there was the most downside acceleration and panic. If there are subsequent lows in the coming weeks and months, I will go out on a limb and say there will be more stocks resisting the decline than we recently saw and we will actually see widespread differentiation.

From the March 23rd low, stocks rocketed higher by 13-21% in the major indices, causing some to conclude a new bull market has started. As you know, I have never been one to hang on the arbitrary metric of 20% in either direction as the line in the sand. In 2011 and 2018, we saw 19.90% declines that people refer to as bull market corrections. However, somehow adding 0.10% would make them into bear markets? That doesn’t make sense.

Anyway, the bulls made an important stand last week and the tiniest of green shoots has now grown and grown. I will add them to my list of things to publish here this week. It’s a lot of charts. The model for the week will be continued volatility with the edge to the bulls at least for the first two days. It becomes less likely as the week wears on. We shouldn’t rule out a small range setting up either.

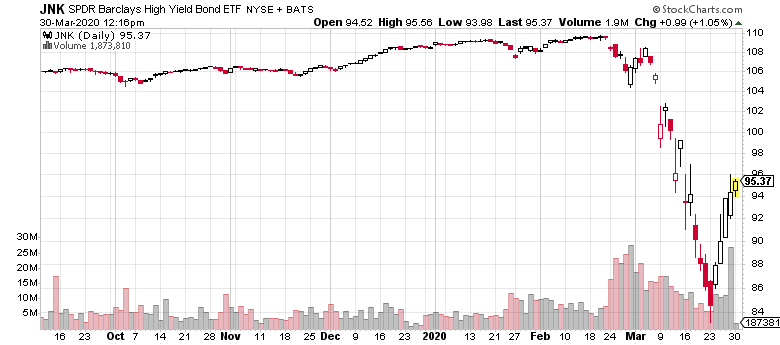

I think it’s important to watch the Volatility Index or VIX to see if it can break lower, signaling less stress in the stock market. I also want to see if long-term treasury bonds can finally stop going up each and every day. Finally, the big winner during Friday’s rout was the high yield bond market. It was supposed to decline as it has been behaving like the stock market. However, it finished higher and is showing the earliest of early attempts at leadership. That’s another tiny green shoot.

Remember, taken in a vacuum, any little green shoot can be easily dismissed. However, when you add them up, the tiniest of green shoots ends up being something significant. The news regarding the virus, especially in New York and other big cities, is going to get worse, perhaps much worse. Watching market reaction will say a lot about where stocks are heading. This bears repeating; it’s not so much what the actual news is, but how stocks react. Bear markets do not end with good news, just like bull markets do not end with bad news. For those waiting for the “all clear” sign to invest, my sense is that it won’t come until stocks have recovered a significant portion of what they lost.