This is NOT 1931 But Still Too Many Looking for Easier Markets

The bull are back in town, at least from Tuesday through Thursday they were. If you even casually follow the markets, you have probably heard that it has been the biggest rally since 1931 after the sharpest decline in the least amount of days since, well, 1931. 1931 was in the heat of Great Depression part I (GDI) which is not an enviable analog. From 1929 to 1932, stocks lost 89% before rallying more than 400% into 1937 when Great Depression part II (GDII) began because the governmental powers that be started taking victory laps, restricting money and tightening credit.

The answer is NO.

I do not believe the current situation even remotely resembles GDI or GDII. People put up 5% and borrowed 95% in the 1920s. The government tried raising taxes during an economic crisis and then putting on protectionist measures. Global governments defaulted on their debt. Because of severe weather, crops were wiped out which led to food shortages. World War II obviously changed all that and the economy was instantly recharged. Some conspiracy theorists argue that FDR knew Pearl Harbor was going to be attacked, but he thought it was the only way to get America into the war. I have no idea and it really doesn’t matter anyway.

Sorry. I got sidetracked.

From the February 19th peak to the March 23rd low, the major market indices lost the following:

Dow Industrials -37%

S&P 500 -34%

S&P 400 -42%

Russell 2000 -41%

NASDAQ 100 -28%

That is a whole lot of red for such a short period of time. From the low on the 23rd to the high on the 26th, the major market indices gained the following:

Dow Industrials +21%

S&P 500 +18%

S&P 400 +21%

Russell 2000 +17%

NASDAQ 100 +13%

That’s a whole lot of green for only three days. However, the major indices are still down:

Dow Industrials 24%

S&P 500 23%

S&P 400 30%

Russell 2000 31%

NASDAQ 100 19%

It has been a crazy week and head shaking month, but that provides a little perspective as to what’s happened to date.

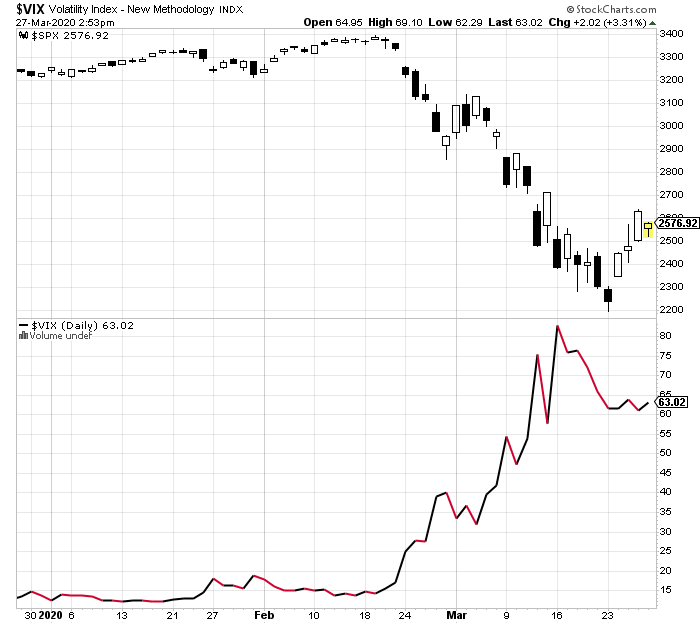

I keep talking about volatility and how it has abated lately as measured by the VIX. On each successive decline, the VIX has declined when it usually rallies. That’s a good thing, however, the volatility index remains stubbornly high at 60+. That is an important thing to watch. We need to see the VIX well below 40 and even 30 before normalcy can return. That won’t happen overnight, but on successive declines into April, we do not want to see the VIX spike higher again to above 80.

One of the many emails I received this week from the many updates I have done asked me if I am worried about anything. I literally laughed out loud. In the 31 years I have been in the business, I have ALWAYS worried about something. I especially worry when I can’t find things to worry to about as was the case to begin 2020. The problem at that time was that the underlying foundation of the market was still pretty solid. Uncharacteristically, it did not warn of impending problems.

Back to the question, of course I worry about things today. I worry that I am hearing only two possible market scenarios here. Either stocks put in a very rare “V” bottom on Monday and a new bull market has begun. Or, stocks are going to see a “W” low with one more decline to revisit Monday’s lows. I don’t hear anyone talking about the major indices cutting through the old lows. That concerns me. However, pundits change their opinions like I scrub my already raw hands these days, all day long.

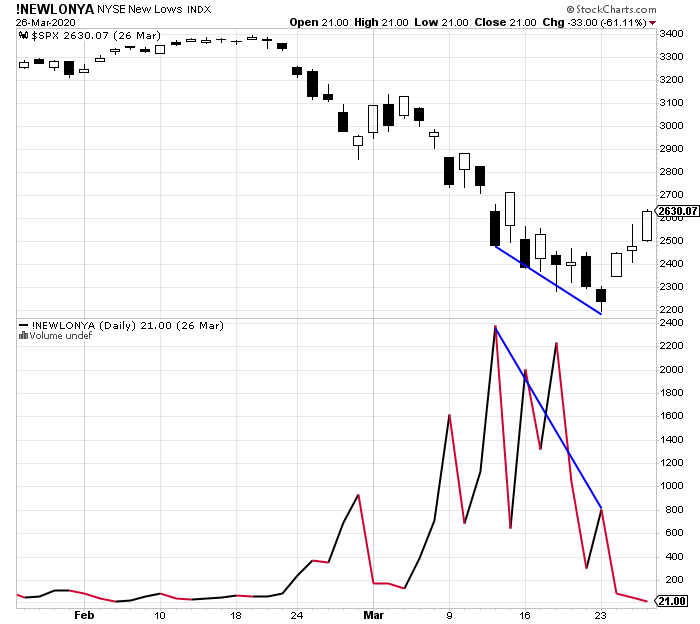

Finally, there were only 27 stocks hitting new lows on Thursday. As you can seen below, we have seen fewer and fewer stocks doing this since March 12th.

The worst of the carnage should be behind us, but that does not insulate the stock market from an undercutting of Monday’s low. Now we get to watch which sectors lead on rally and decline days. The bulls definitely do not want to see staples and utilities up big on big up days. We want to see people moving into “risk on” sectors.

I will likely work on an update over the weekend since the weather looks crummy in CT and there’s not much to do anyway besides throw and hit with my kids. That’s baseball and softball, not physical violence!

Please stay safe and let me know if I can help you with anything.

Paul