Looking for a Green Shoot Within a Week

Stocks have not been up on back to back days since the market peaked one month ago. As I mentioned the other day, we have seen 6 independent days of widespread panic as you can see in the chart below. The very first sign of even a tradable rally will likely occur when we finally see stocks able to rally for two straight days. That opportunity should come next week at some point.

Once we see some sort of low forming there will be a lot of damage to repair. The way that happens is by entering a wide trading range that can sometimes be violent. Stocks should initially rally into the zone formed by the blue, horizontal lines which is roughly Dow 22,000 to 23,500. What we want to see is the historic level of volatility begin to abate.

How exactly do we measure volatility?

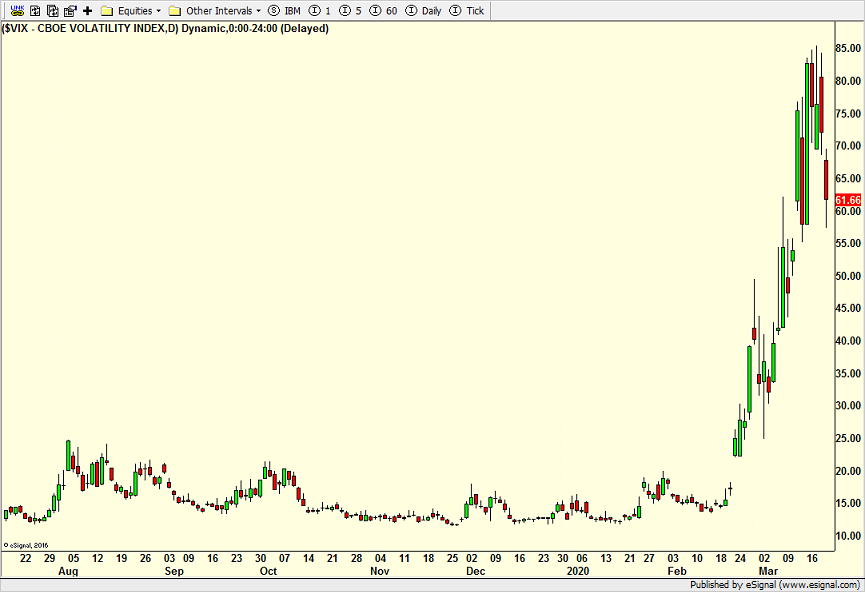

There are many ways, but looking below at the chart of the CBOE Volatility Index or VIX is a common one. I won’t go into the wonky details of the how the VIX is calculated. You can read about it online if you have the patience. The long and short of it is that volatility almost always goes through the roof during stock market declines. A VIX between 10 and 20 is fairly normal. This week, it hit 85. The VIX usually collapses quickly when downside momentum begins to slow down and that’s a good sign.

To give you a long-term view of the VIX over the many market declines we have seen this century, take a look at the chart below. You can see enormous spikes in volatility at the end 2018, early 2018, mid-2015, mid-2011, mid-2010 and of course, in the fall of 2008. It’s unheard of for the VIX to stay elevated for long periods of time because that type of downside momentum in stocks can’t last. It’s just hard to imagine while you are living through it.

I suspect that after the market gets through the middle of next week, we will see volatility begin to abate and stocks begin to find their footing. I don’t imagine that investors will be lining up to buy heading into a weekend. And Mondays have not been kind to the bulls over the past month. There may be one selling wave left. However, if you can close your eyes, swallow hard and wait until Wednesday, I think stocks may be closer to calming with a green shoot sprouting here or there.