A Decline for the Ages – Turnaround Tuesday Possible

Seeing the Dow Industrials lose 2000 points in a single day was something that wasn’t even on my worst case radar as recently as last month. But as we have seen many times this century with the advent and domination of computerized trading, things change at warp speed. Declines that used to take weeks, months and even quarters to unfold and complete are now compressed into days and weeks. Risk no longer slowly builds; it happens all at once. I have discussed several metrics to put this decline into context and the latest should come as no shock. This correction is now the deepest ever coming from an all-time high.

While I have always been a proponent of the free market, that doesn’t mean there shouldn’t be any regulation nor safeguards. Until 2007, traders couldn’t just short stocks willy nilly. They had to wait until a stock traded at a higher price so there couldn’t be a piling on effect to drive a stock into the ground. That rule, the uptick rule, was changed to eliminate that for what seemed like all the right reasons. That was, until the computers took over and now dominate trading. Keep in mind, people only complain and cry foul on big down days. They love the computers on big up days.

On a closing basis, this correction is now approaching 19% which puts it in line with 2018 and 2011. Those declines lasted 108 and 65 days respectively. The current one is 14 days old. 2018’s correction was fully recovered in roughly four months. 2011 took five months.

Monday’s decline saw widespread panic on almost every indicator and metric I use. As I mentioned in yesterday’s post, it was downright ugly at the open. For a brief 15 minute period, the stock market was “limit down”, meaning it was down 7% and no trades could take place at lower prices for 15 minutes. That type of “circuit breaker” was put in place after the 1987 crash from President Reagan’s working group on capital markets, more affectionately known as the Plunge Protection Team (PPT), something I find preposterous. Where was the PPT during the 2000-2002 and 2007-2009 bear markets?

Anyway, on Monday, once stocks reopened from their 15 minute timeout, they began to stabilize as water always finds its level. By the end of the day, stocks closed basically where they opened. As ugly and difficult as the day was for investors, that was more than just a moral victory. I think there is a decent to good chance that we either saw a short-term bottom or we will with one more decline this morning.There are just too many historic extremes for selling to continue unabated.

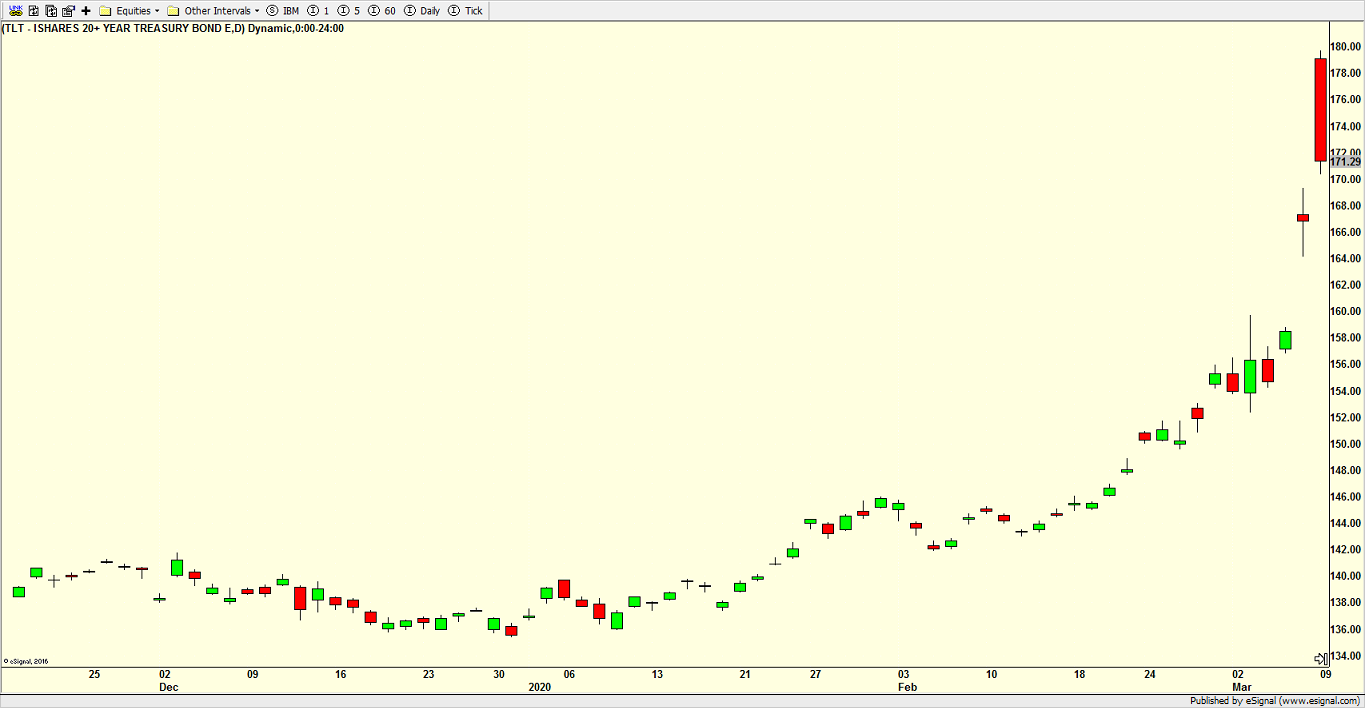

If I had to offer one indication that something was beginning to change, it came from the Treasury bond market which has been rallying at strongest pace of all-time. Stocks have been held captive by this. At its low point yesterday, the yield on the 10 Year Note was just under 0.40%. That is per year! In other words, if you gave the government your money for 10 years, you would earn 0.40% in interest each year. That’s it. Talk about panic and fear.

In the chart below, on the far right, you can see what is a long red candle. That means the instrument began the day near its high and closed near its low. Remember, this instrument is the long-term bond which has been moving exact opposite to stocks. With stocks closing down 2000 points, I would have expected bonds to hold their own and close relatively well, not at the bottom of their daily range like they did. Again, even though stocks closed down 2000 points, the bears could not make any headway during the day. And bonds finally got sold which is a very early and preliminary sign some of the pressure is starting to abate.

This is anything but the “all clear”. It’s just a building block along with so many other indicators I watch that say stocks are in the bottoming zone. With stock futures up strongly in the pre-market as I finally finish this update, the bulls really need to make some noise and not let the bears push stocks back down into the close. If we see upside follow through during the day that lasts into the close, another “Turnaround Tuesday” could be in the cards.