Junk Bonds & the A/D Line Say All is Okay

From open to close, stocks have traded in a narrow range most of this week and around the same level each day except for Tuesday. As the old highs in the Dow Industrials, S&P 500 and NASDAQ 100 have come into reach, investors are pausing as they usually do to assess risk and reward. While I do not think it’s a layup for a breakout right here, I feel very confident that Dow 28,000 will be kissed this quarter with leadership coming from some of the key sectors like semis, discretionary and banks.

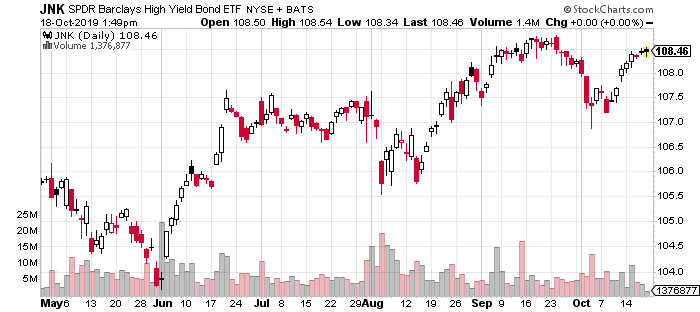

For all the talk about high yield bonds lagging and quietly forecasting doom, they are pretty close to an all-time high.

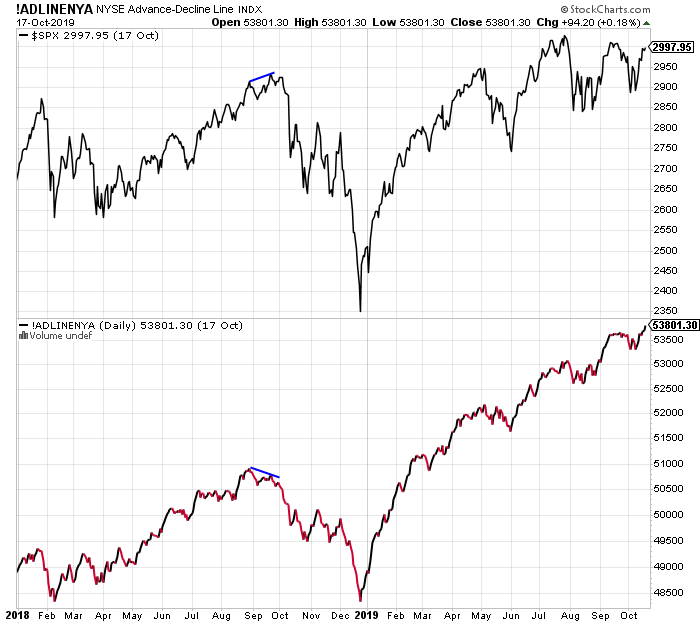

Additionally, let’s take a look at the NYSE A/D Line which is actually at new highs now. I have heard from pundits that the rally lacks participation, but the facts don’t support those claims. While stocks could always pull back, the odds favor the Q3 lows as being the lowest prices for the rest of the year.