Bulls Thwart Bears With Another Low

Last Wednesday as stocks had pulled back to the lower end of the recent trading range, I thought we were about to see a showdown between the bulls and the bears. That battle was fought one day later as an early morning mini-collapse triggered by a poor manufacturing number flushed out the sellers and allowed the bulls to come roaring back the rest of the day with a beautiful intra-day reversal. On Friday, the bulls added to those gains and put the major indices right back into the old range as you can see below on the far right of the chart. This is textbook behavior for ridding the market of short-term, weak handed traders.

At this point, in the strongest of strong markets, stocks should pause and then continue higher towards the old highs without any downside. I am not so sure that’s where we are today, but I wouldn’t sell the bulls short. Another scenario has stocks seeing some modest weakness this week and then beginning a more meaningful assault higher next week. I don’t see an immediate collapse right here.

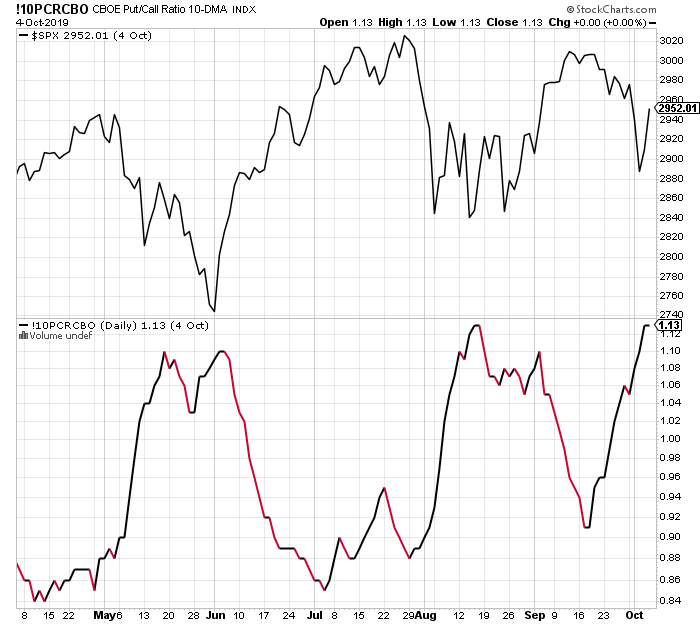

With only a 6% decline, it’s a bit odd to see traders behave so bearishly in the options market. Below, you can see the S&P 500 on top with a 10 day average of volume in options looking for lower prices versus higher ones. Option traders are just as negative now as they were at market lows in August and June. While this is only one single indicator and doesn’t guarantee anything, it is certainly fuel for the bulls to move prices higher this month.