Bears Continue to Laugh & Scoff and Be Embarrassingly Wrong

When listening to the pundits and reading my Twitter feed over the past month or so, it has been fairly negative which it has basically been for the majority of the bull market with few key exceptions like January 2018. Whenever I prepare for a media segment, I usually start by saying that no one has been more bullish than I have on balance for the entire bull market. Most of my quantitative, upside price targets for the Dow were initially dismissed by most, then scoffed at and ridiculed and then given the chance of playing out before they were widely accepted as “everyone knew that”.

After the bear market ended, I remember being laughed at for calling for Dow 10,000, 15,000, 18,000 and then the preposterous 20,000. When the Dow first closed above 20,000 for five straight days, it opened the door for Dow 30,000 before the bull market finally ended. Currently, Dow 28,000 is up next, followed by 30,000. I really do love when people so easily dismiss these targets as the negativity has fueled so much of the bull market.

Not one single time did I forecast a bear market beginning unless and until certain criteria were met. Every now and then I randomly watch an old interview and with few exceptions, I am the bull and the bear is using all these scare tactics which have absolutely no historical significance and no current data to support the claim.

Anyway, after an August that “felt” a whole lot worse than it actually was, stocks began the new month with a selloff. Keep in mind that August ended with the Dow briefly poking above the trading range it had been in for most of the month as you can see on the chart below.

Many times, the first time through a range is met with resistance as late comers hop on the train, only to be immediately disappointed by larger investors who believe the move won’t hold. In this case, we saw a decline from that point into the first day of September which is the last red bar on the right side of the chart. It also resulted in what I labeled as a “bear trap” which means that the bears got too excited in their negativity and were trapped in losing positions as stocks immediately and powerfully reversed course the very next day on September 4th.

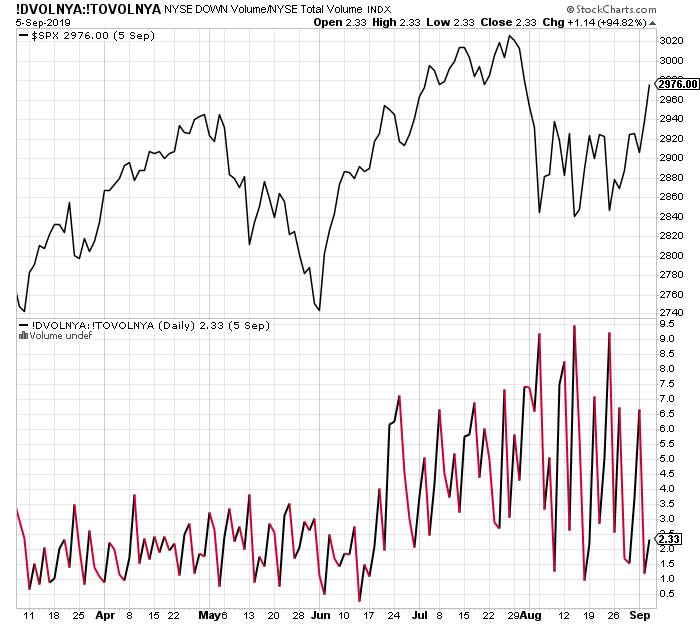

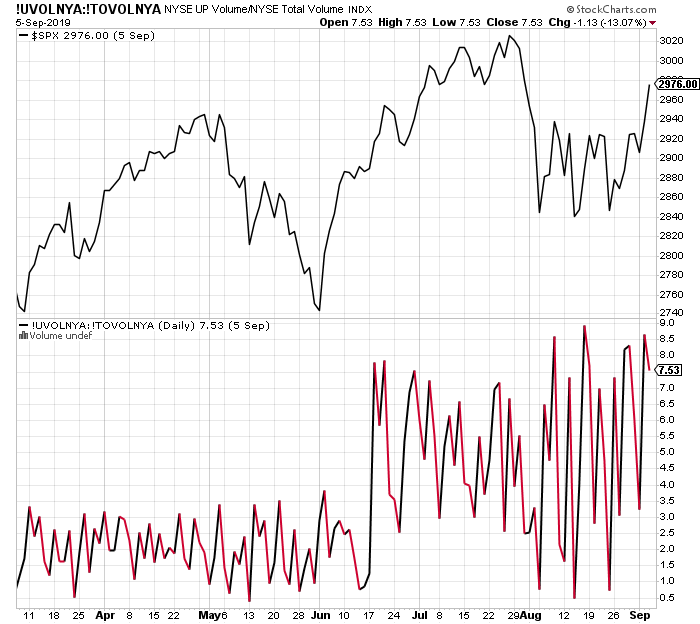

On September 5th, we can see that stocks opened sharply higher, leaving a blank space or “gap” on the chart which led to further pain for the bears. To make matters worse, this week had more confirmation that the selling we saw in August was over. Many analysts watch the amount of shares traded in stocks going up versus stocks going down for signs of extreme behavior. The most usual representation is a ratio or up versus down volume.

August saw a number of days where 90% of the volume was on the downside. So close to all-time highs, that’s unusual behavior and signals very little patience among investors and the desire to sell first and ask questions later. In other words, it creates the negativity needed for a market low much sooner than later.

This week we have seen a reversal where up volume has been swamping down volume to the tune of two days with at least 80%. And depending on the data source you use, there was a 90% day. Coming on the heels of a market pullback, this surge in volume in advancing stocks confirms the rally.