Strong Sector Leadership. Seasonal Headwind This Week.

As I wrote about last week, stocks ended their deepest and longest pullback since the Christmas bottom. And that was all of 3% and 5 days. Not much for the bears to hang their hopes on. I also commented that I wanted to see which sectors led out of that pullback since it was unlikely that the rising tide would continue to lift all ships.

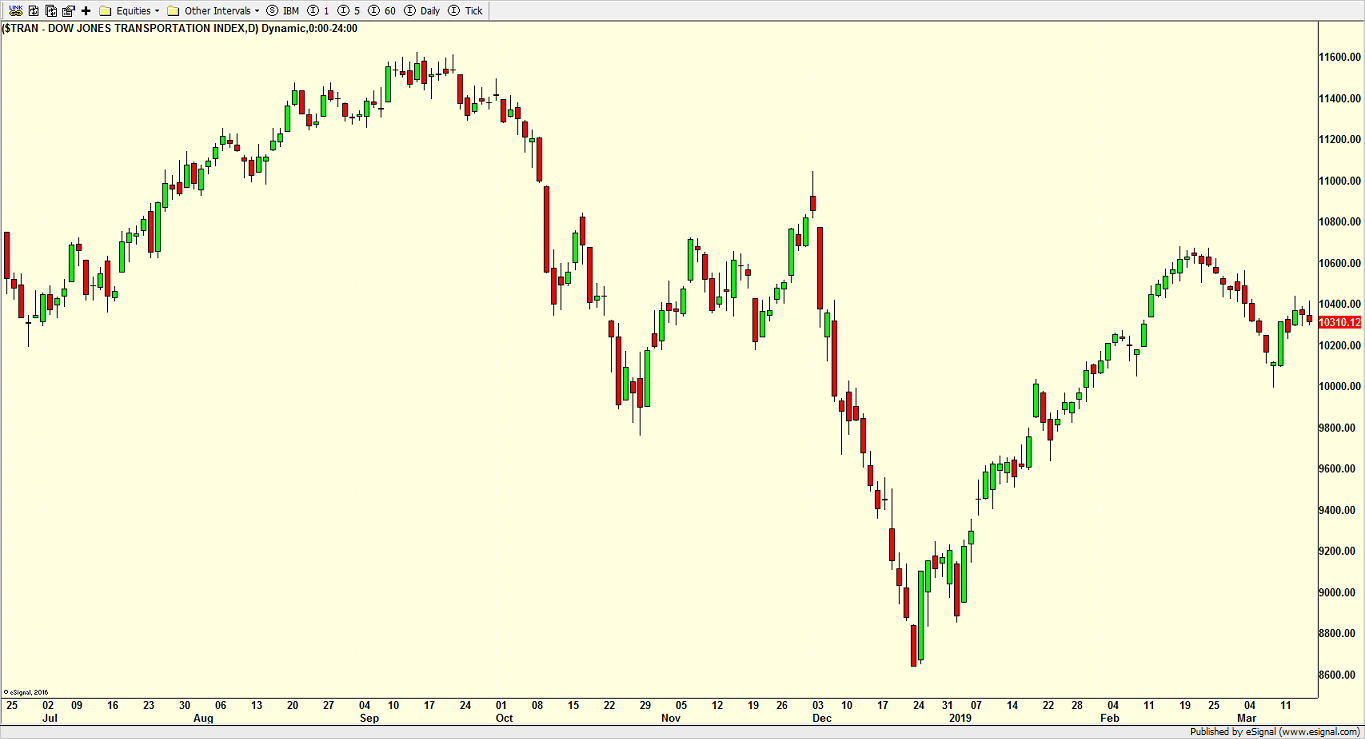

Since the March 8th low, the bulls should be proud that it’s been a “risk on” rally with biotech, energy, healthcare and technology leading the way. That is fairly strong leadership. Lagging are the defensive groups plus materials and transports. That’s not bad either although the masses are all up in arms about the transports. While they do matter, I am not going put too much weight on them as they are still rallying fairly well as you can see below.

Finally, with last week’s quadruple expiration of options and futures and stocks rallying, there is a strong trend for some weakness this week. While I don’t have a strong opinion of the magnitude, I don’t think it should be a significant decline if it comes.