Bulls Continue to Do Nothing Wrong, Yet

Stocks continue to do nothing wrong as they bounce sharply from the epic selling wave in December. On Tuesday most of the major stock market indices made new recovery highs. Leadership has been constructive, meaning the more aggressive sectors have been leading. Risk on, if you will. However, stocks have also rallied right into the zone I first mentioned on December 21 as the most logical area where the bears could put up a fight. From here we will see if the bulls begin to waver.

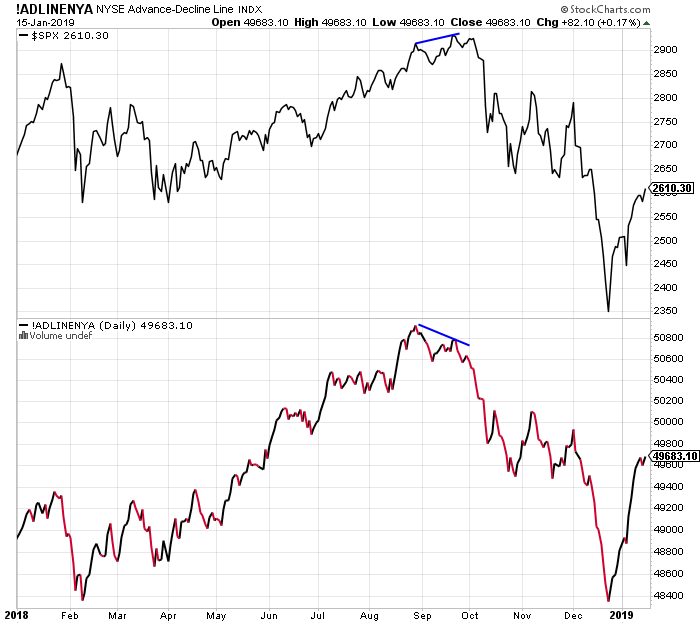

Some of you asked why I haven’t mentioned the NYSE Advance/Decline Line at all when I was so focused on it for most of 2018. It’s because I don’t find it all that helpful when stocks begin a rally. Almost every single time stocks lift after a significant decline, the NYSE A/D Line lifts as well as you can see below. The only help it would offer if in the rarest case, it did not rally with stocks. Now that would be a huge concern. From here, I want to look for points where the NYSE A/D Line goes down as stocks are making new recovery highs. That’s a warning sign.