Early Signs of Waning Downside Momentum

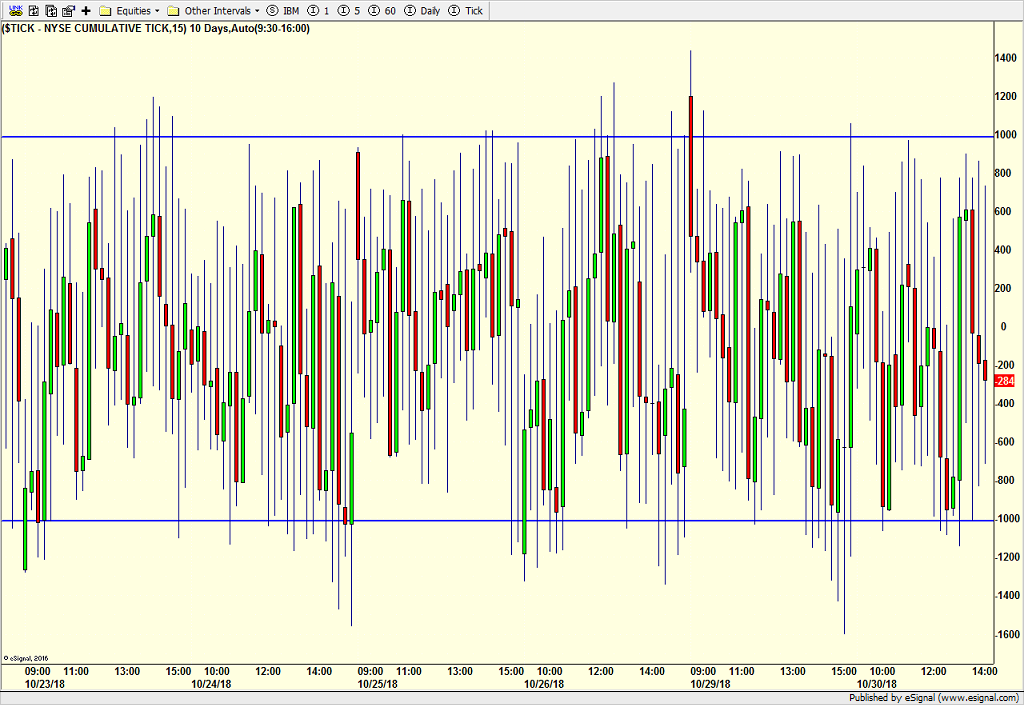

The selling has been relentless. It’s come in strong waves with some of the most powerful moves in many years. If you watch the intra day “tick” indicator which essentially tells you the cumulative price move for all stocks on the NYSE, up or down, there have been two massive and historic waves where the tick exceeded -1600. That shows indiscriminate selling and it’s not mom and pop hitting the sell button.

The reasons are not important and we never truly know anyway. Right now, it’s “get me out at any price!” The magnitude has certainly exceeded my call for a mid to upper single digit decline.

In the very short-term, there should be a rally and I don’t mean a few hundred Dow points. It could be significant. However, I think this rally also fails and leads to a final selling wave over the coming two weeks or so.

If you are looking for bright spots, there haven’t been many.

Banks have not made new lows since last week.

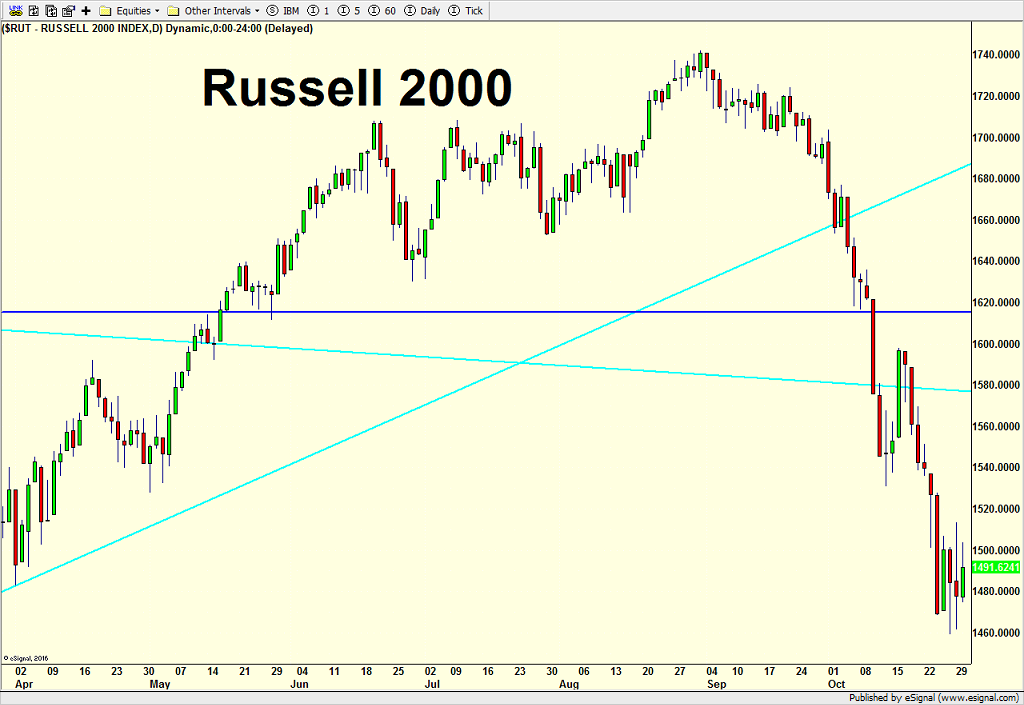

The Russell 2000 small cap index did not make new lows on Monday.

The Volatility Index (VIX) remains below the levels seen on October 11.

There are more signs like this, but not enough. My point is that downside momentum is just starting to wane. That rarely happens right at the bottom. It is usually a leading indicator. Patience is needed now. The “thrashing around” I keep calling for is here. It’s easy to make emotional mistakes. Don’t do it!