Buy Yom Kippur But Participation is Waning

As the Jewish holiday of Yom Kippur is here, so ends the seasonal trend of selling Rosh Hashanah and buying Yom Kippur. It worked out very well this year, if you did the exact opposite! Rosh Hashanah was the most recent little low and stocks quietly rallied right through to Yom Kippur.

The Dow Industrials and the S&P 500 have reasserted themselves while the Russell 2000 and NASDAQ 100 have lagged, not exactly the healthiest backdrop. In sector land, banks continue to be weak and tiny bit concerning, especially when bond yields have rallied which is usually a tailwind.

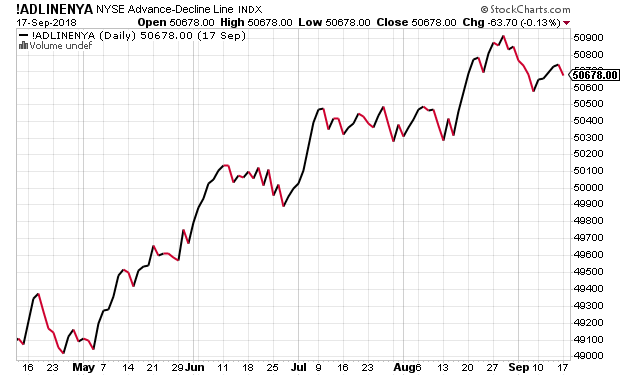

High yield bonds have behaved reasonably well but the NYSE A/D Line has finally started to show some signs of deterioration and weakness. This condition can persist and not matter for three months or 23 months. It’s not a timely indicator, but it is very important.

Even though stocks have rallied of late, the internals have not kept pace, let alone lead. The short-term concern I have been writing about remains in place.