Pause to Refresh. Transports Looking Juicy

It looks like Monday’s failure by the bulls put in a short-term peak and stocks will either trade sideways for a bit or pullback below Tuesday’s low. There shouldn’t be too much price deterioration. We have some overbought readings in the major indices so if stocks can resist much weakness, that could speak volumes about the next move which should be to new highs.

On the key sector front, banks and discretionary are quietly stepping up while semis appear to need a rest. Transports may be the most interesting of the lot as this week was the fourth time they tried to get through 10,850 on that index. My sense is that on the fifth try, this key sector will blast through and head to new highs, perhaps in July or August.

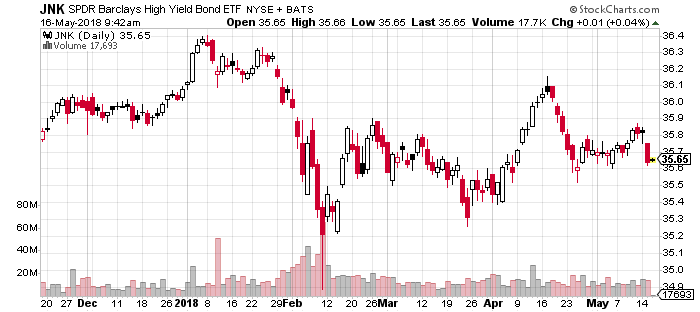

The only significant concern I have now is the same one I have had, high yield bonds. They are not leading and barely rallying. While this behavior can sometimes warn falsely or even warn for more than a year, it’s something to keep front and center as my favorite canary in the coal mine.

In Friday’s piece, I will spend some time on the recent spike in yield on the 10 year Treasury note which has everyone’s attention.