Short-Term Remains Murky But Dow 27,000 on Tap for Summer

Almost like clockwork when I wrote about the bears giving up which caused me to be concerned, stocks declined. However, given the elevated level of volatility a few day pullback isn’t going to raise many eyebrows. With stocks closing off of the lows on Thursday after yet another nonsensical piece of information leaked regarding the Mueller investigation and Trump, the bulls should an opportunity on Friday. If the major indices close at their highs for the week, we will likely see more upside next week. If stocks close below Thursday’s low, we should see downside follow through next week. While lack of overall volume doesn’t concern me at all, it does bother me that the stock market can’t even generate a single 80% day where 80% of the volume is in stocks going up. After a string of 90% down days, we should have seen at least an 80% day or two on the upside to confirm that the rally is sustainable.

Looking at sector leadership, semis were bludgeoned on Thursday and now threaten to breach the recent lows. Although banks were higher during Thursday’s carnage, they re one bad day away from new lows. On the flip side, discretionary and transports have rallied smartly with the latter probably being a little more important. It is “funny” that with crude oil at new highs and approaching $70, I don’t hear any of the pundits spewing about about how these two groups always move in opposite directions because the transportation companies have such a high reliance on energy. Just another myth not supported by fact.

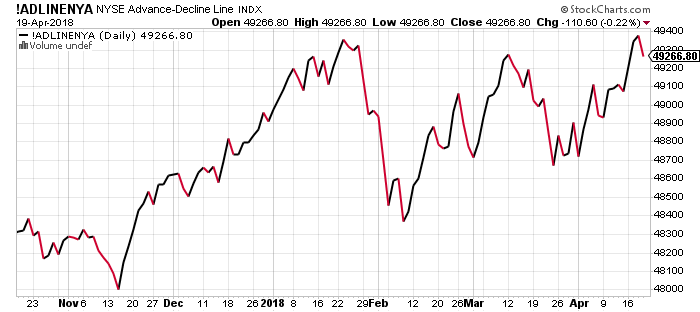

Turning to one of my favorite long-term indicators, the New York Stock Exchange Advance/Decline is one of the best ways to determine overall participation in rallies. When stocks made their peak in January, this indicator was at an all-time high, leading me to continue to conclude that more new highs should follow after the correction. And just this week, the NYSE AD Line made a fresh new high by a whisker, reconfirming that the bull market remains alive.

As I email, meet and speak with clients this year, people are uniformly surprised that my thoughts, writing, opinion and forecast have included some fairly negatives scenarios. While I obviously don’t know what will come to fruition, for the first time in years and years, I now have economic doubts that aren’t just somewhere way out on the horizon. We are getting closer and closer to clear and present danger. As I have started to mention, a mild recession is a very real possibility between mid 2019 and mid 2020. And if that’s the case, a bear market in stocks will accompany that. For now, let’s focus on the short and intermediate-term and see if stocks can accommodate my forecast for Dow 27,000 over the summer.

Have a great weekend. After a quick trip to MD and NC this past Tuesday I am now heading to the east coast of Florida and then Orlando to visit with clients and attend the annual NAAIM Uncommon Knowledge conference. I know. I know. With the amazing spring weather in New England, how will I adjust to temps in the 80s with sun. I will do my best.