***SPECIAL Fed Update – Rates Are Going Up Again & Then Some***

Stock Market Behavior Models for the Day

As with every Federal Open Market Committee (FOMC) statement day, there is a model for the stock market to follow pre and post announcement. Certain environments have very strong tendencies while others do not. Over the past few meetings, many of the strongest trends muted although the system that said to sell on the close of the meeting hit a home run. The S&P immediately crashed from 2824 to 2645 or 6% during this quarter’s big market swoon. To be fair, although 6% was the return for the system, it certainly wasn’t due to the post-FOMC trend that the trade was based on. Sometimes, it’s better to be lucky than good!

As with most statement days, the model for the day calls for stocks to return plus or minus 0.50% until 2:00 PM. There is a 90% chance that occurs. If the stock market opens outside of that range, there is a strong trend to see stocks move in the opposite direction until 2:00 PM. For example, if the Dow opens down 1%, the model says to buy at the open and hold until at least 2:00 PM.

With stocks somewhat on the defensive lately, the next model calls for stocks to close higher today and rally after 2:00 PM. That is usually a very strong trend, 80%+, especially after seeing weakness into statement day (today).

Rate Hike Coming Today – At Least 3 More On The Way After

This is Chairman Jay Powell’s first meeting as chairman. History has shown that markets typically test newly confirmed chairs very early in their term and 2018 was no different as stocks immediately collapsed in early February as Powell assumed the reigns. The change from Yellen to Powell should be fairly seamless as their views were very much in line. I do not expect Powell to deviate much from Yellen’s course.

As such, everyone is expecting another 1/4% rate hike today at 2 pm.

In my 2018 Fearless Forecast, I called for 3.5 interest rate hikes by the Fed this year. With the data so far this year, I am sticking with that forecast with the risk to the upside, meaning that four or an outside shot at five hikes could be in the cards.

After announcing their hike today, I also expect Powell et al to slightly upgrade their economic forecast, continuing to lay the groundwork for higher short-term interest rates. At the same time the Fed will forge ahead with their program to reduce the size of their massive balance sheet, accumulated through three rounds of quantitative easing. As I have said too many times to count, this experiment is going to end very badly.

The Fed should have chosen one or the other. Hike rates or sell assets. Conducting both is an horrendous decision in my view. There is absolutely no doubt in my mind that recession is going to hit by the election of 2020. While it may be mild like we saw after 9-11, it will still hurt. And the Fed’s fingerprints will be all over this as they have before every single recession of the modern era. It seems like the Fed just can’t help themselves. They are destined to screw up economic expansions. Of course, there is always some external final catalyst like the financial crisis, 9-11, S&L crisis, etc. However, the Fed has always been hiking rates right into those events, long after common sense dictated a pause.

Let’s remember that the Fed was asleep at the wheel before the 1987 crash. In fact, Alan Greenspan, one of the worst Fed chairs of all-time, actually raised interest rates just before that fateful day, stepping on the throat of liquidity and turning a routine bull market correction into a 30% bear market and crash. In 1998 before Russia defaulted on her debt and Long Term Capital almost took down the entire financial system, the Fed was raising rates again. Just after the Dotcom Bubble burst in March 2000, ole Alan started hiking rates in May 2000. And let’s not even go to 2007 where Ben Bernanke whom I view as one of the greats, proclaimed that there would be no contagion from the sub prime mortgage collapse.

Yes. The Fed needs to stop.

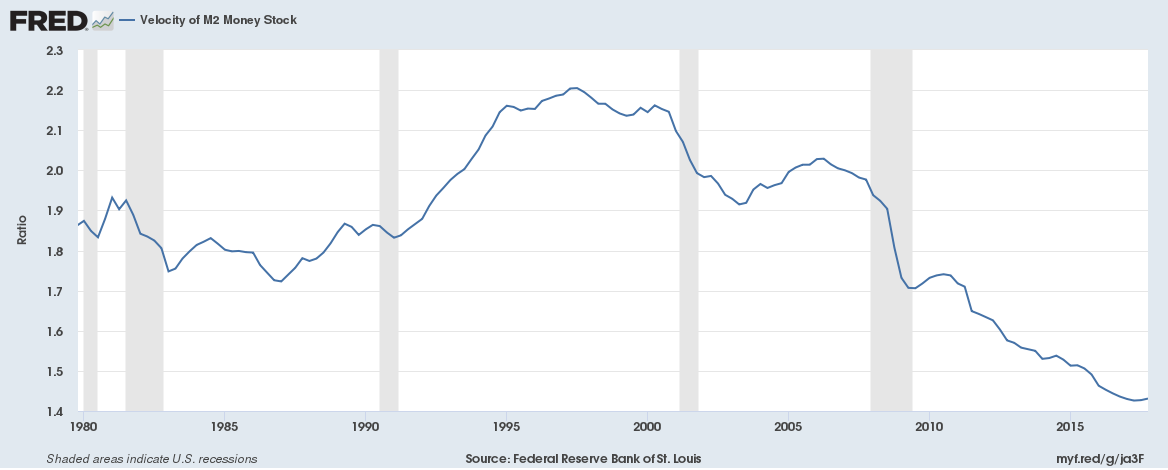

Velocity of Money Most Important

Below is a chart I have shown at least quarterly since 2008. With the exception of a brief period from mid 2009 to mid 2010, the velocity of money collapsed. It’s still too early to conclude, but it does look like it stopped going down in 2017 and might be just slightly starting to turn up. If 2017 does turn out to be the bottom, this could could eventually lead to the commodity boom I see for the 2020s, especially ex energy.

In the easiest terms, M2V measures how many times one unit of currency is turned over a period of time in the economy. As you can see, it’s been in a disastrous bear market since 1998 which just so happens to be the year where the Internet starting becoming a real force in the economy. Although it did uptick during the housing boom as rates went up, it turned out to be just a bounce before the collapse continued right to the present.

This single chart definitely speaks to some structural problems in the financial system. Money is not getting turned over and desperately needs to. The economy has been suffering for many years and will not fully recover and function normally until money velocity rallies. This is one chart the Fed should be focused on all of the time.

It would be interesting to see the impact if the Fed stopped paying banks for keeping reserves with the Fed. That could presumably force money out from the Fed and into loans or other performing assets. It continues to boggle my mind why no one called the Fed out on this and certainly not Yellen at her quarterly press conferences. Hopefully, someone will question Chairman Powell on this!