Small Caps, Semis & Junk Leading. Banks Looking Sick

Stocks ended last week on firm footing as the bounce saw four nice days. With more North Korea tensions in the air, it will be interesting to see if the stock market finally cares or just uses this as an excuse to open mildly lower. Very quietly as I have mentioned before, the Russell 2000 has been leading the major indices. That does have bullish implications if it holds on.

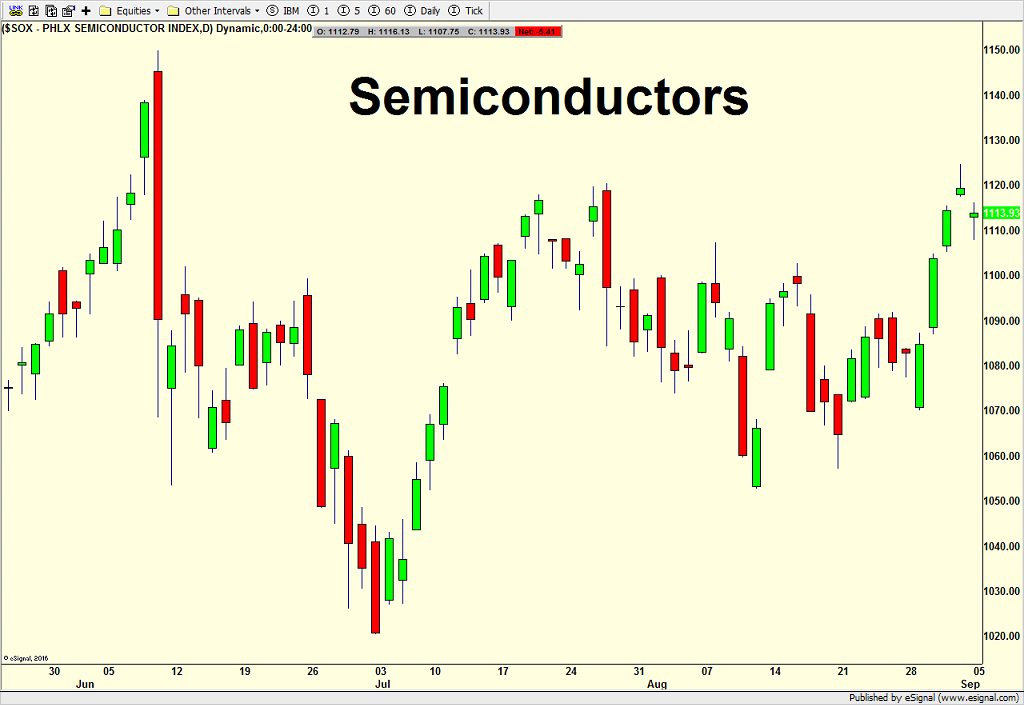

Additionally, the semis which have been the only key sector leading, are one strong day from new highs.

One sector that has me particularly concerned is the banks. They look sick. While that isn’t likely to have a short-term impact, it’s something that must be watched over the intermediate and long-term.

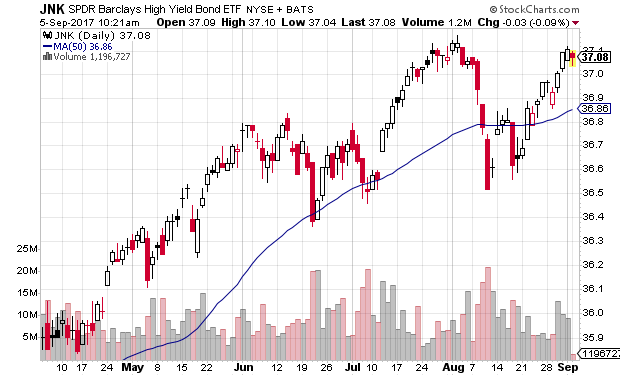

Turning to my favorite canary in the coal mine, high yield bonds are behaving more like semis than banks, trading just one good day from new highs. It would make me feel a whole lot better if this key group can score new highs before rolling over again.

Once again, we have a number of crosscurrents. If stocks gather themselves and rally, I think there will be a good opportunity to sell at new highs. Should stocks rollover first, I will become more concerned about the downside. In either case, I do not think stocks are blasting off higher until next quarter.

If you would like to be notified by email when a new post is made here, please sign up HERE