Oil and Energy Diverging

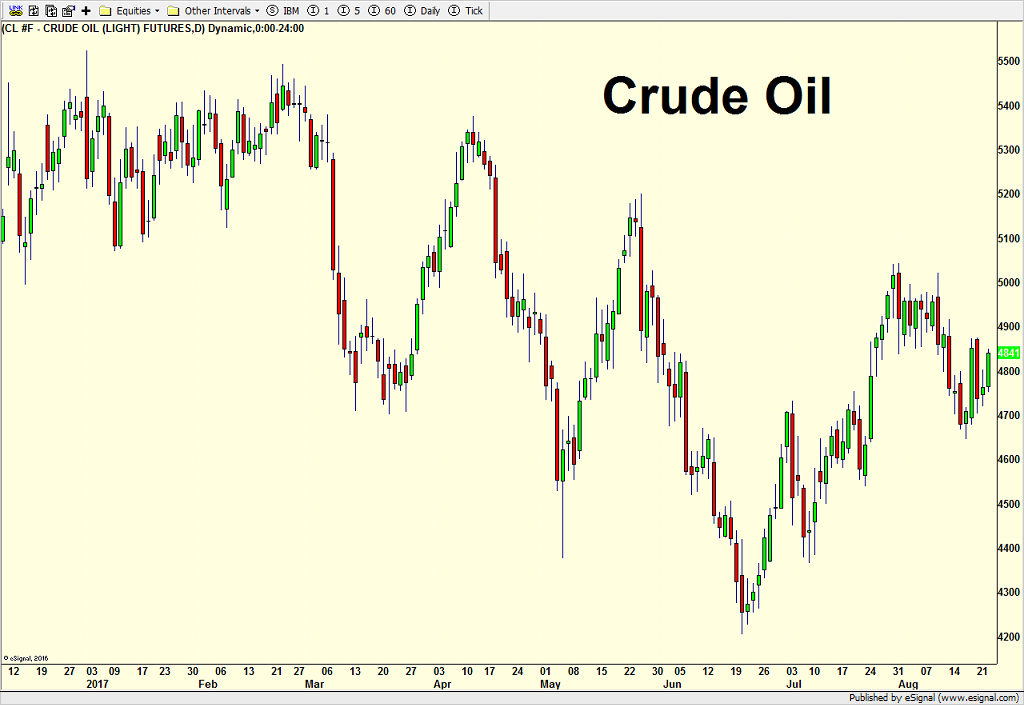

It seems like the energy sector debacle has received very little attention among the mainstream media this year. Even the financial media don’t really care. I am guessing that’s because crude oil has somewhat bucked the bearish trend the stocks have been on as you can see below. Oil has been very volatile and mildly lower. The stocks have been downright ugly. This has been an unusually long period of behavior like this.

In the past, the stocks have usually been on the correct side, but the relationship currently seems to be broken. Of course, people are going to speculate nonsense about OPEC and shale and manipulation. Don’t buy it! If I had to put a trade on right now, it would be to own the energy stocks and short crude oil. If I had to choose, I would look for a final bout of capitulation where investors throw in the towel all at once and then look to buy energy stocks. That’s what has been missing all along.

Investors just keep holding on to the likes of Exxon and Chevron and the like, hoping they will bottom. That’s the kind of behavior we saw during the Dotcom Bubble bursting 17 years ago although I do not believe energy is even remotely like that.

If you would like to be notified by email when a new post is made here, please sign up HERE