Boring Fed Day On Tap

Model for the Day

As with every Federal Open Market Committee (FOMC) statement day, there is a model for the stock market to follow pre and post announcement. Certain environments have very strong tendencies while others do not. Six meetings ago was one of the rare times where the models strongly called for a rally on statement day which was correct as well as a decline a few days later which was also correct.

Today, as with most statement days, the first model calls for stocks to return plus or minus 0.50% until 2:00 PM. There is a 90% chance that occurs. The next model calls for stocks to close higher today and rally after 2:00 PM. That is usually a very strong trend, 75%+, however with the bulls using a lot of energy over the past few weeks, that trend’s power has been muted significantly to less than 50%. That’s not exactly the kind of trend worth trading.

Finally, there may be a trend setting up for a post statement day decline, but there are a number of factors that still need to line up.

No Rate Hike But Balance Sheet Taper…

Janet Yellen and her friends at the Fed have done an excellent job of preparing the markets for interest rate hikes this year. There haven’t been any surprises on that front. Recently, they have been chatting up a storm regarding a plan to reduce the size of the Fed’s $4 trillion plus balance sheet. You can expect to hear a little more about this in their statement today after they leave rates unchanged. With the Fed’s annual Jackson Hole retreat about a month away, Yellen and Company should continue to prepare the markets for a formal announcement in six weeks with lots of information released at Jackson Hole.

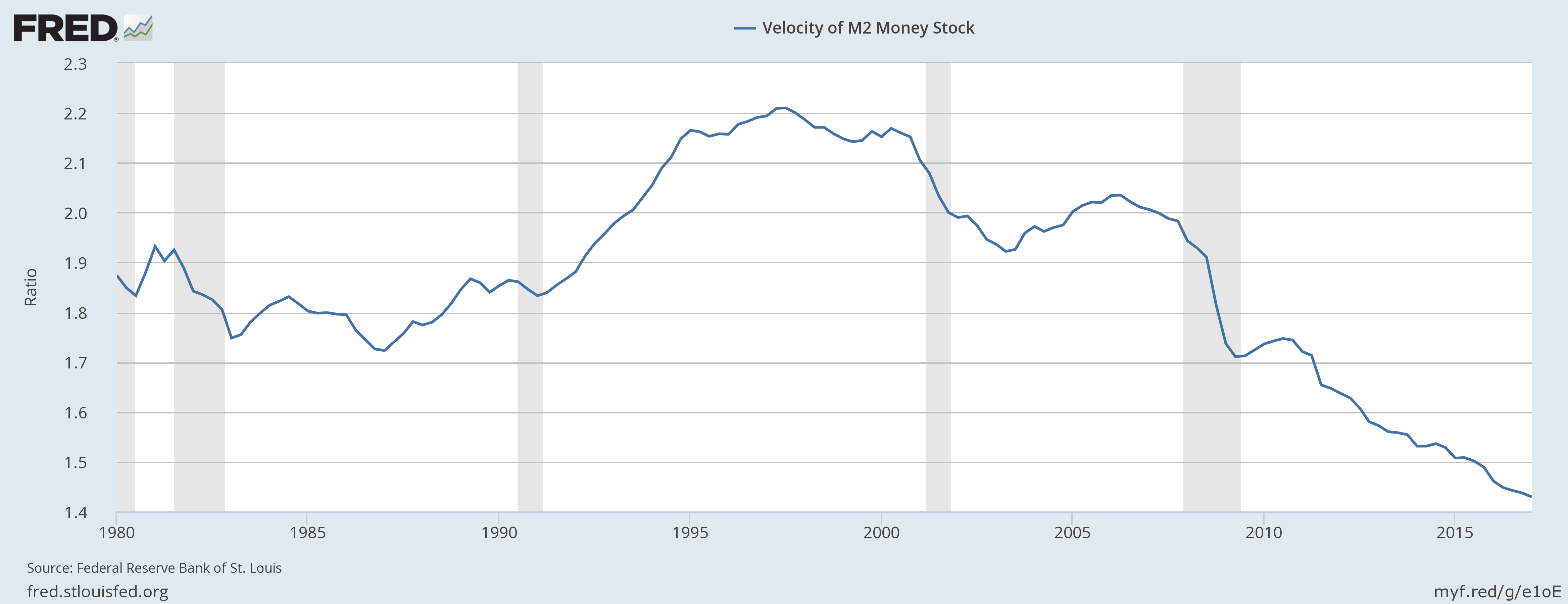

Velocity of Money Still Collapsing

Turning to a chart I continue to show time and time again, below is a long-term chart of the velocity of money (M2V) produced by the St. Louis Fed. In the easiest terms, M2V measures how many times one unit of currency is turned over a period of time in the economy. As you can see, it’s been in a bear market since 1998 which just so happens to be the year where the Internet starting becoming a real force in the economy. Although it did uptick during the housing boom as rates went up, it turned out to be just a bounce before the collapse continued right to the present.

This single chart definitely speaks to some structural problems in the financial system. Money is not getting turned over and desperately needs to. It would be interesting to see the impact if the Fed stopped paying banks for keeping reserves with the Fed. That could presumably force money out from the Fed and into loans or other performing assets.

If you would like to be notified by email when a new post is made here, please sign up HERE