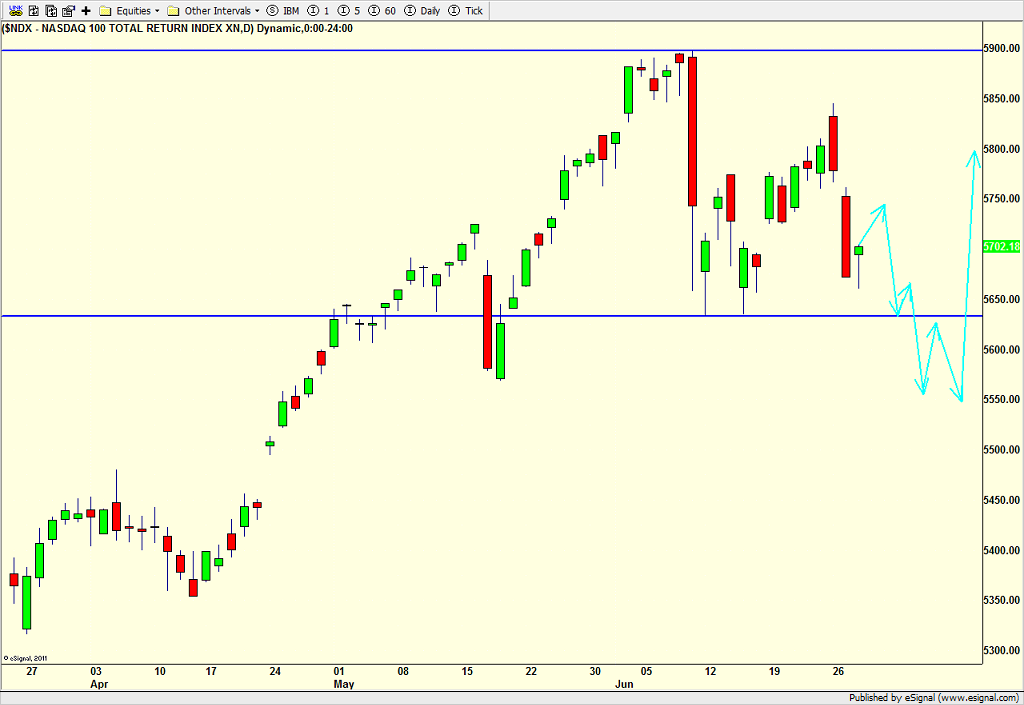

NASDAQ 100 to Bounce and then Fully Correct

As has been the case since the big “shock” day in the NASDAQ 100 on June 9, I have been a little cautious (neutral) on that index and more positive on the Dow and S&P as it looked like leadership was rotating. In healthy bull markets, this is normal and a good thing. The problem comes when leadership stops rotating into the more aggressive sectors and heads into the defensive ones like staples, utilities and REITs.

Tuesday saw follow through from Monday’s sharp reversal in the tech space, leaving a glaring and ugly day for the bulls to overcome in the NASDAQ 100. The same was not seen in the other major indices. With the NASDAQ 100 revisiting the June lows yet again, the bulls are going to be hard pressed to fend off sellers for long.

I think we can can generally see stocks bounce until after the 4th holiday, but then we could or should see the NASDAQ 100 and tech follow a path somewhat like I show below in light blue. There could be a stair step decline which will feel and look worse than I offer, but in the end, it will take the former leader below the first “shock” day in May. IF my scenario is even remotely correct, that should set the stage later in Q3 for the NASDAQ 100 and tech to resume leadership and soar beyond the June peak.

Regarding the other indices, I do not believe they will head higher with the NASDAQ 100 fully correcting, but I don’t believe there will be any decline of significance so soon. Keep a close eye on high yield bonds which have bounced back over the past few days. And don’t forget that the NYSE A/D Line hit yet another all-time high this week. Bull market don’t end this way regardless of what some of the idiots say publicly!

If you would like to be notified by email when a new post is made here, please sign up HERE