Banks Looking for a Bottom Amid General Market Strength

With earnings season in full swing and estimates ramped up by Wall Street, companies will really need to impress for stocks to get a boost. Banks are front and center right now. With the banking index down 10% since the early march peak, I am looking for a bottom in this sector and revisiting of the old highs later this quarter. However, the most important hurdle will be for this group to close above the 93 level, which will effectively negate the most negative scenarios.

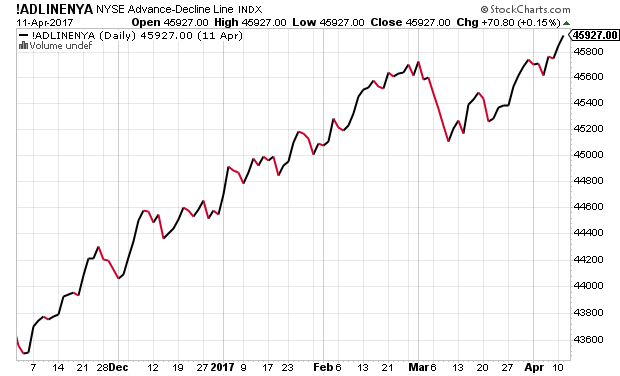

With stocks continuing to trade in a small range, there has been strong selling beneath the surface as measured by a technical indicator called the TRIN. This indicator has been relatively high for the passed few weeks. However, the NYSE A/D Line which you can see below and I wrote about the other day, just hit a fresh all-time high this week. Bull markets have never ended with this kind of broad participation and strength. Normally, there is at least three months and as much as 21 months of weakening before the bull market ends.

If you would like to be notified by email when a new post is made here, please sign up HERE